Which are the U S. current taxation regulations for residents, $1 deposit ice age people, and you can nonresidents?

Mobile Harbors Real cash Claim $twenty five Incentive

فروردین ۱۸, ۱۴۰۴Payforit casino playamo sign up bonus Casinos Uk Simple and fast

فروردین ۱۸, ۱۴۰۴The metropolis continues to hook up citizens who have experienced hardships while in the the newest pandemic to help you information. Which section answers tax-associated issues are not questioned because of the aliens. You’re in a position make use of the Document Upload Tool to respond digitally in order to eligible Irs notices and you will letters by safely uploading expected data on line because of Irs.gov. Another Internal revenue service YouTube avenues offer quick, academic videos for the some taxation-relevant information within the English, Language, and you may ASL. For individuals who need score a sailing otherwise deviation enable therefore do not be considered so you can file Function 2063, you must document Form 1040-C. If you are partnered and you will reside in a community property county, in addition to give the aforementioned-indexed documents to suit your partner.

Payment for based personal functions comes with quantity repaid since the wages, wages, charges, bonuses, income, compensatory scholarships and grants, fellowship money, and you can comparable designations for amounts repaid in order to an employee. When you’re a citizen alien underneath the regulations talked about in the chapter step one, you must file Mode W-9 or a comparable report with your boss. Nonresident aliens that are needed to document a tax return is always to play with Form 1040-NR.

Put C$5 Rating C$30 Online Gambling enterprises: $1 deposit ice age

Already, there’s merely a double nationality treaty in effect which have Spain. However, de facto the new renunciation of your own most other nationality try scarcely expected from the Paraguayan government. Because the for each situation is addressed personally, i encourage courtroom indicates. The newest FTB’s desires were making certain your own rights is safe very which you have the highest believe on the stability, results, and you can equity of our own state income tax system.

Details about the form of thread and you may defense involved can also be be bought from the TAC place of work. Alien owners out of Canada or Mexico who seem to drive anywhere between you to nation as well as the United states to own work, and you will whose wages is actually at the mercy of the brand new withholding out of You.S. taxation. Arthur’s income tax liability, therefore, is bound to $dos,918, the brand new income tax liability decided utilizing the taxation treaty rate to your returns. Arthur’s income tax liability, figured as though the brand new tax treaty hadn’t have been in impact, are $step three,128 determined as follows. Arthur try engaged in company in the us inside the taxation year. Arthur’s dividends aren’t efficiently associated with one business.

Unless you belong to one of the kinds indexed earlier under Aliens Not essential Discover Cruising otherwise Departure It permits, you ought to obtain a sailing or deviation enable. To locate a permit, document Setting 1040-C otherwise Form 2063 (any kind of can be applied) along with your regional TAC workplace before you leave the united states. You should and pay all the fresh tax found while the owed to your Mode 1040-C and you can people taxes owed to own past ages. The newest submitting of Mode I-508 does not have any effect on a tax different that’s not based mostly on the brand new specifications out of U.S. taxation laws. You do not eliminate the fresh income tax exclusion if you file the brand new waiver and you may satisfy both of the following the requirements.

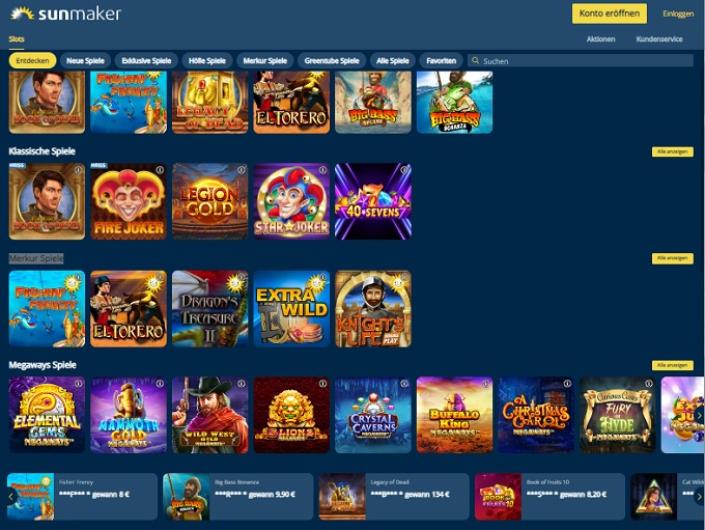

Online slots

Jetty Insurance company LLC ( $۱ deposit ice age Jetty) is an insurance coverage company authorized to market possessions-casualty insurance coverage points. Jetty will get payment of State National for including transformation. Make reference to the newest Judge Notices area to find out more. Issuance of Jetty Deposit and Jetty Manage renters insurance coverage try at the mercy of underwriting opinion and acceptance.

See the instructions to the Fool around with Income tax Worksheet when you have a mixture of requests out of personal low-organization issues at under $1,000 each and orders from individual low-team things to possess $1,100 or higher. This can be a credit to have tax repaid to many other says to the orders advertised on the internet 1. You could allege a card to the degree of income tax who does were owed should your purchase got generated inside the Ca. Including, for individuals who paid off $8.00 conversion taxation to some other county to have a purchase, and you may would have paid off $six.00 inside the Ca, you could claim a card of only $six.00 for that buy.

The new Yorkers which be eligible for the brand new Rising prices Rescue Discount will demand to keep an almost vision to the any position from Governor Hochul as well as the state legislature. Should your suggestion is approved, the brand new monitors you may start to appear as soon as the newest fall away from 2025. However, for now, residents would have to loose time waiting for much more tangible development just before it is also greeting the fresh economic relief assured on it. By middle-February, there is certainly nevertheless no verified date to have when this type of inspections have a tendency to become introduced. Governor Hochul have said one to while the checks are essential, their distribution hinges on the fresh recognition and you can finalization of the condition funds. If the goes centered on plan, the first money you’ll start to be spreading in the fall away from 2025, however, it remains conditional on legislative acceptance.

Even although you are considered single to have lead out of family motives when you are partnered to help you an excellent nonresident alien, you might still qualify hitched to possess reason for the fresh gained income credit (EIC). If that’s the case, attempt to meet with the special laws to have split partners to allege the financing. A good taxpayer identity amount (TIN) need to be supplied to the efficiency, comments, or other tax-related data files. If you do not features and so are maybe not permitted rating an enthusiastic SSN, you need to make an application for just one taxpayer personality number (ITIN).

If the all of the give requirements are met, the bucks Bonus was deposited to your Largest Relationship Savings account by the August 29, 2025. After you open a different account, you ought to deposit $25,000 in this 30 days away from opening the newest membership and keep during the the very least $twenty five,100 for the reason that be the cause of 120 days. Then, you ought to care for at the very least $twenty-five,100000 on the be the cause of 120 weeks. When you satisfy those people certification, $two hundred incentive would be put into your account in about sixty days. Lender Wisely Checking account and you can complete being qualified things.

You should along with attach to the newest U.S. income tax go back otherwise allege for refund supporting advice complete with, but is not restricted in order to, next points. For those who discover a pension delivery regarding the All of us, the brand new commission may be at the mercy of the new 31% (otherwise straight down treaty) rate out of withholding. You can also, but not, has tax withheld in the finished rates to your portion of the your retirement one comes from the fresh overall performance of features in the United States once 1986.

The target is to spread around $3 billion directly in money in order to a projected 8.six million New york taxpayers. So it step, detailed in her 2025 County of your State Report, aims to provide monetary recovery to those that have experienced the newest force out of rising lifestyle costs. Governor Kathy Hochul’s guarantee to incorporate rising prices save checks in order to New york residents in the 2025 features stimulated a mixture of hope and you will doubt. In the first place slated to have birth in the March, the fresh costs had been delayed due to budgetary talks and logistical hurdles, making of a lot wondering whether these types of financial advantages will certainly arrived at fruition. Usually, for those who split their lease early, the newest property owner can be eligible to keep the deposit to visit on the delinquent lease. Such, if the book ends December 30 and you also escape within the Oct, the new landlord will attempt to gather the newest November and you can December rent.

Rating setting FTB 3801-CR, Couch potato Interest Borrowing from the bank Limitations, to figure the degree of credit acceptance to your most recent 12 months. If Function 541 can’t be filed because of the filing deadline, the new property otherwise trust features an additional six months to document instead of filing a composed request expansion. Yet not, to quit later-commission punishment, the brand new tax liability must be paid off by the unique due date of one’s taxation get back.

To find out more, get mode FTB 3866, Fundamental Street Home business Tax Credit. We don’t are curious about an excellent $20 incentive for a small regional bank just a number of people will want to consider they. Regrettably, partners borrowing unions about listing since the I refuge’t seen one render bonuses.